Cross-border QRIS payments in Indonesia are seen to be used more frequently among foreign tourists from Malaysia, Singapore, and Thailand.

Bank Indonesia (BI) has reported a significant increase in the use of the cross-border Quick Response Code Indonesia (QRIS) by foreign tourists in Indonesia. As of the second quarter of 2024, the number of transactions grew by 225.54% on an annual basis (year-on-year). In line with this rise in transactions, the number of QRIS users had reached 50.50 million consumers. Additionally, the number of merchants offering QRIS as an alternative method of payment had reached 32.71 million.

“There is a trend of increasing QRIS usage between countries if we look at its developments,” said BI Deputy Governor, Filianingsih Hendarta, in a press conference at her office in Jakarta on Wednesday, the 17th of July.

Hendarta noted that the use of QRIS saw an especially notable increase in June 2024 among tourists from Singapore, Malaysia, and Thailand. Tourists from Singapore, in particular, experienced a growth of 28% month-to-month, with the areas experiencing the largest increase being Jakarta and Riau.

Meanwhile, the use of QRIS among tourists from Thailand increased by 13% month-to-month in Jakarta and West Java. In the case of tourists from Malaysia, Hendarta reported an increase of 8% month-to-month, with the largest areas experiencing growth being Jakarta and West Java as well.

Hendarta revealed that the use of QRIS by Indonesians abroad is growing as well. In Thailand, the number of QRIS users among Indonesian citizens increased by 9% month-to-month. In Malaysia, the number of QRIS users among Indonesian citizens grew by 4% month-to-month.

However, QRIS usage in Singapore experienced a contraction. “In Singapore, there has been a decline: 12% month-on-month,” she added.

Hendarta mentioned that BI will continue to expand the scope of cross-border QRIS which supports local currency transactions or LCT. Recently, BI had signed an agreement to use QRIS with South Korea and the United Arab Emirates. In the near future, she said, cross-border QRIS should also be available in other countries such as India and Japan.

“Thus, wait for the launch date, and then, you can buy tteokbokki and sushi [in their country of origin, respectively] with QRIS [as your method of payment],” Hendarta concluded.

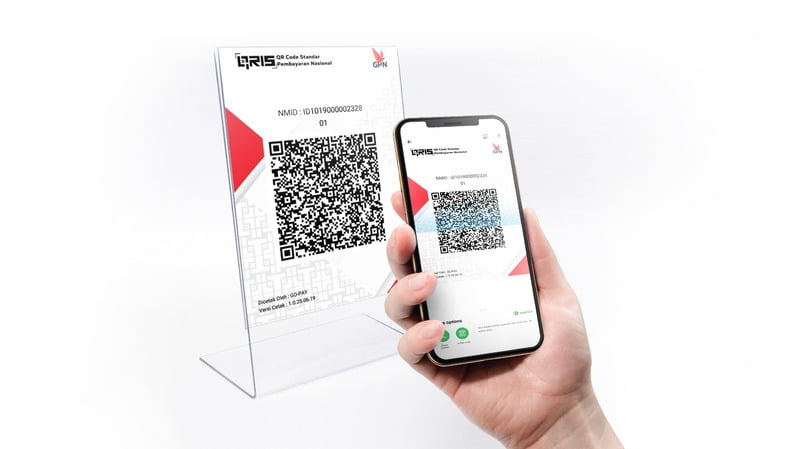

As of now, cross-border QRIS can be used in Indonesia’s neighbouring countries – namely Malaysia, Singapore, and Thailand – as the former is linked to mobile banking applications by several registered banks in Indonesia, such as Bank Central Asia (BCA) and Bank Mandiri.