Value-added tax (VAT) applies to certain goods and services sold in Indonesia. When should you register as a VAT-liable company in Indonesia? How to start reporting your liabilities?

Here is where we answer the most frequently asked questions about VAT along with providing VAT calculation examples.

When is it required to register as a VAT-liable company in Indonesia?

Registering as a VAT-liable company is required once your annual revenue reaches Rp4.8billion (~US$360,000).

Note that you can also register as a VAT-liable company voluntarily if your revenue is less than RP48billion per year.

You do not have to be VAT-liable, but you will want to register if your revenue comes mostly from other Indonesian companies.

FAQs about VAT in Indonesia

We’ve answered the most frequently asked questions about VAT in Indonesia to help you navigate in the local taxation system better.

1. When is VAT implemented?

A VAT-liable company in Indonesia must pay taxes for the following goods and services:

• Delivering taxable goods and services

• Importing taxable goods

• Utilising intangible goods from abroad

• Exporting tangible and intangible goods and services

The general VAT rate in Indonesia is 10%. Decided by the government, some goods and services may have either higher or lower rates, or even be exempt from VAT entirely.

2. Which of my goods and services are exempt from VAT in Indonesia?

Through incentives provided by the Indonesian government, some items are exempt from VAT or it is just not collected:

• Food and drinks served in a restaurant, hotel, café, and similar places (including a caterer)

• Gold and obligations

• Medical services

• Social services

• Financial services

• Insurance

• Education services

• Recreational services

• Hotels

• Manpower services

If all the goods and services you sell are exempt, your business is exempt and you will not be able to register for VAT in Indonesia. Hence, you cannot reclaim VAT on your business purchases or expenses.

3. How much VAT do I need to pay in Indonesia?

The VAT rate in Indonesia is generally 10%.

4. When am I entitled to a VAT refund in Indonesia?

VAT in one tax period is credited with the VAT out during the same tax period. Meaning that if in one tax period, the VAT out is greater than the VAT in, the taxable entrepreneur pays the VAT.

Note that if during one tax period, the creditable VAT is greater than the VAT out, then the excess tax is compensated to the next tax period. For excess VAT in, a request for return can be submitted at the end of the financial year.

Are there any questions we’ve left unanswered? Pass them over to info@emerhub.com and we’ll answer them too!

Examples of a VAT Calculation for a VAT-liable Company in Indonesia

#1 VAT out is bigger than VAT in

Here is an example of how you can calculate VAT for your VAT-liable company in Indonesia when the VAT out is bigger than in during one tax period:

The VAT out is bigger than VAT in during one tax period | |

| ‘A’ sells service to ‘B’ with an agreed price | Rp20,000,000 |

| The VAT applies to the service (VAT out) | Rp2,000,000 |

| ‘A’ buys equipment from provider ‘C’ | Rp15,000,000 |

| The VAT applies to the goods (VAT in) | Rp1,500,000 |

‘A’ must pay the balance for the additional VAT on goods Rp500,000. ‘A’ can use the balance of their VAT out.

#2 VAT in is bigger than the VAT out

Now, learn how you can calculate VAT for your VAT-liable company in Indonesia when the VAT in is bigger than the VAT out during one tax period:

The VAT in is bigger than VAT out during one tax period | |

| ‘A’ sells service to ‘B’ with an agreed price | Rp20,000,000 |

| The VAT applies to the service (VAT out) | Rp2,000,000 |

| ‘A’ buys equipment from provider ‘C’ | Rp25,000,000 |

| The VAT applies to the goods (VAT in) | Rp2,500,000 |

‘A’ doesn’t need to pay the balance for the additional VAT on goods (Rp500,000). ‘A’ can use the balance of their VAT out.

Restitution and Carrying Forward Your Balance from the VAT in

According to Indonesian tax regulations, your balance from VAT in will be carried forward for up to the 3 following months. What is quite unusual is that after this period, any left balance from your VAT in will be gone.

Let’s illustrate this with an example of a tax period in Indonesia shifting from May to June. See what happens to an overpayment:

VAT period starting from May 2019 | |

| VAT out | Rp2,000,000 |

| VAT in | Rp4,500,000 (-) |

| An overpayment in May 2019 | Rp2,500,000 |

VAT period continuing in June 2019 | |

| VAT out | Rp3,000,000 |

| VAT in | Rp2,000,000 (-) |

| Underpayment | Rp1,000,000 |

| Compensation from May 2019 | Rp2,500,000 (-) |

| Overpayment June 2019 | Rp1,500,000 |

It is possible to request a refund for the excess VAT in at the end of the financial year. Emerhub has been providing accounting and tax services since 2011, our in-house accountants in Jakarta and Bali will gladly support you by planning your VAT payments in Indonesia. Reach out to us for restitution assistance and VAT planning.

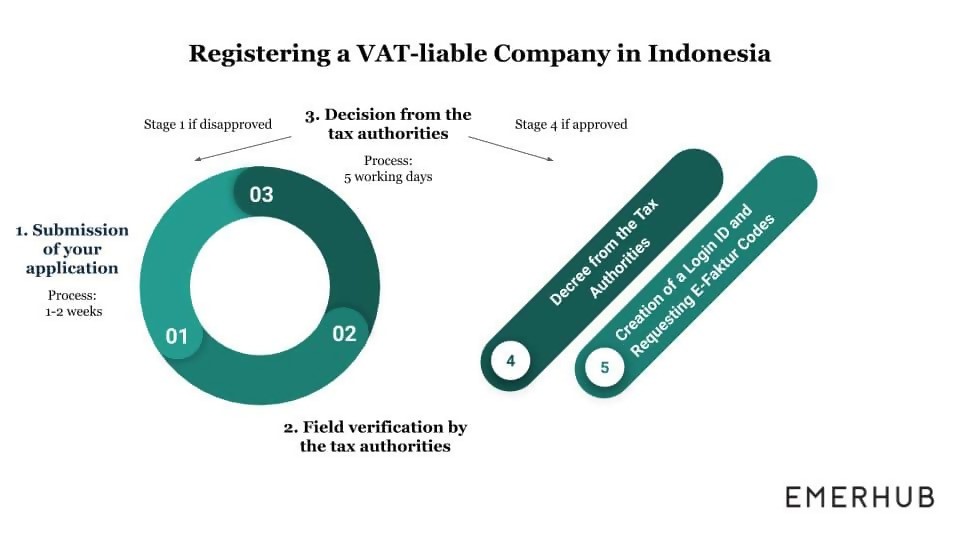

Registering as a VAT-liable Company in Indonesia

Registering as a VAT-liable company will be very beneficial for a business that frequently conducts large transactions.

Although becoming a VAT-liable company does not take much time, it is not a straightforward process. It mostly involves a subjective assessment from the tax authorities. For example, a field check is one of the requirements.

Step 1: Submitting the Application

For starters, you need the copies of complete company documents. Note that a public notary must also legalise this set of paperwork for you.

One of the directors of the company must have a tax card (Nomor Pokok Wajib Pajak, NPWP) in Indonesia. A foreign director should first proceed with applying for work and stay permit (KITAS) and can then get a tax card. Another option would be appointing an Indonesian director.

The third and last requirement when applying is that you must already be operating. During this stage, you will also prove to pay withholding taxes on the office rental payments. Keep in mind that an application showing that you are registered into a virtual office is allowed as long as:

• the tax authority in that area allows it

• you can show an alternative operational office

Emerhub’s virtual office service will guarantee the approval of a VAT-liable company in Indonesia. Schedule a call or book an appointment with our consultants in Bali or Jakarta today.

Step 2: Field Verification by the Tax Authorities

As soon as your application is lodged, expect a ‘sudden visit’ from the tax office. The purpose of this visit is to check whether the information on your application is valid. The authorities can stop by anytime between 7-12 working days after receiving and evaluating your application.

Make sure that either you or someone from your staff is present during the planned inspection. Failing to meet the tax officer will result in your application being denied.

Step 3: Approving or Declining Your Application

The final decision is made, at the latest, 5 working days after the tax officers have visited you. You will either receive a decree confirming you are now a VAT-liable company or a rejection letter.

Those receiving a decree will also get an access code and can start using the online VAT system. See below what happens if your application is rejected.

Step 4: Director’s Visit to the Tax Office

Keep in mind that the decree for the VAT-liable company does not automatically mean that you can start issuing the 10% VAT invoices to clients. As soon as you receive the decree and the code, you must visit the tax office.

The sole purpose of the visit is to create a login ID and password. As this is a confidential procedure, the director of the company must physically attend and confirm the information with the authorities. Once this is done, you can start charging an additional VAT on top of your invoice value.

Why Some Applications are Rejected

There are two key reasons why your application may have been rejected. First being that the tax authorities in your district do not approve VAT-liable companies that rent a virtual office.

Secondly, you were unable to prove to the authorities that you are running operational activities in Indonesia. You likely failed to show during the field visit that you have employees on your payroll or that you run business activities.

Emerhub is happy to advise you further on setting up a VAT-liable company in Indonesia and explain how using our virtual office service will guarantee the approval of a VAT-liable company.

Get in touch with us info@indonesiaexpat.biz to discuss your opportunities in Indonesia further.