Analysts say Indonesia’s rupiah will further fluctuate.

Meanwhile, the government and Central Bank experiment with stimulus packages and market intervention.

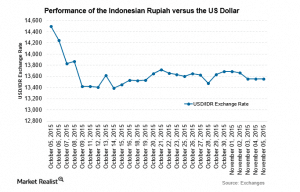

In August, the rupiah touched a 17-year low of 14,800 against the US dollar. Then, in October, it surged more than any other currency in Asia, hitting 13,400. The government claims the stronger rupiah was the result of six stimulus packages and the Central Bank’s intervention that supposedly created market-calming circumstances.

“There are two main factors [related to] the rising rupiah. The first is when Indonesia’s Central Bank releases policies, such as intervention to keep the rupiah’s volatility, liquid, and supply-demand [levels] manageable so as to reduce the risk of speculation,” says Head of the Economic Projection and Policy Simulation Division at Indonesia’s Central Bank IGP Wira Kusuma in an interview with Indonesia Expat. “Secondly, [in this case] the government’s six stimulus packages also sent positive sentiment to investors.”

The stronger rupiah was only short-lived, however, as it again weakened to 13,775 on November 20. Although it hasn’t gone completely back to its lowest rate, Divya Devesh, a strategist at British multinational banking and financial services company Standard Chartered, predicts the Indonesian rupiah will continue to fluctuate between 13,500 and 14,000 until the beginning of next year.

To better understand the rupiah’s future, one must first become familiar with the driving factor of its rise and decline. When the rupiah rose in October, apart from the Central Bank’s intervention, there were also external factors at play from two of the world’s economic powerhouses. The first was uncertainty from the US Federal Reserve, which resulted in higher interest rates. The US also had a higher unemployment rate than originally forecasted, which indicated the nation’s economic recovery wasn’t as stellar as investors may have thought. Second, the European Central Bank also signalled it would inject more stimulus to boost emerging market currencies, like the rupiah.

Additionally, the decline of the rupiah is largely affected by investors who wait and speculate about the Federal Reserve’s interest rates. If the rate increases, investors will move their portfolios to the US and thereby cause a dip in the rupiah’s value. Currently, about 60 percent of the nation’s stock market is owned by foreign investors, making Indonesia’s currency value heavily contingent on this group of investors’ decisions.

Within the country, there are yet more variables at play. An excessive amount of hot money investing [capital that’s frequently transferred between financial institutions in an attempt to maximise interest or capital gains]; a small market for foreign currencies; the negative growth of exports; and a deficit in the country’s balance of payments also determine the rupiah’s future.

Given that the rupiah is largely driven by external factors, one should ask: why has the currency not yet gained a stronger foothold?

Enny Sri Hartati, macroeconomic researcher at the Institute for Development of Economics and Finance tells Indonesia Expat, “Indonesia’s trade performance, especially in the oil and gas sectors, has been in a deficit since 2011. Consequently, the trade deficit puts pressure on the rupiah and our exchange reserve is low.”

The rupiah’s weak and fluctuating nature implies several things, especially for the country’s overall economic health and level of attractiveness to foreign and local investors alike.

“The embattled rupiah will impede economic growth as we can see in 2015. [This year’s] growth only ranges from 4.6 to 4.7 percent. The risk of default from private sectors is also higher because now the rupiah is getting weaker,” explains Hartati.

When a currency is weak, a country will usually try to take advantage of this by ramping up exports. For example, China sometimes devalues its currency intentionally to boost exports. The logical question is: can Indonesia do this, too?

Hartati answers, “Unfortunately the weak rupiah cannot act as momentum to push exports because more than 80 percent of our exports are commodities or raw materials, which experience the price decline. This directly affects the growth of regional economies, which rely on commodity exports, such as Kalimantan, Sulawesi, and Sumatra.”

Hartati adds, “At the same time, manufacturers cannot boost their exports because they are dependent on imported materials. Prices get more expensive due to the weak value of the rupiah.”

It’s important to remember that expensive imported items can also lead to inflation, which can make manufacturing industries worse off, even to the point of needing to lay employees off due to increased production costs.

Kusuma acknowledges that Indonesia’s exports in 2015 have slowed due to weakening global economic growth and falling commodity prices. However, he says in the third quarter of this year, economic growth increased slightly due to more public spending. In a media briefing, Kunta W.D. Nugraha, Director of Budget Formulation at the Finance Ministry, said the government is on track to pay out 85 to 90 percent of its capital spending plan in 2015.

“In the future, Indonesia’s domestic economy will be the motor of our growth due to high uncertainty of the global economy’s future,” adds Kusuma. Hartati further explains the fluctuation of Indonesia’s rupiah has potential to confuse investors while making business plans.

“Many business transactions depend on foreign exchange,” she says. “Therefore, when the foreign exchange is not stable, businesses will hesitate to decide about their plan ahead. It’s not impossible that the investors will move their capital inflow to countries with more stable currencies.”

In spite of it all, however, Hartati can still see a bright side to the weak rupiah. “If the hot money in Indonesia is moving to other countries, local investors can take the opportunity to buy affordable stocks. Thus, the decline of rupiah can also invite optimism of local stock market players,” she suggests.

Aware of the costs and benefits of a weak rupiah, the government along with the Central Bank must continue their existing policies to bolster the currency’s foothold.

Hartati makes a recommendation. “The Central Bank can reduce the use of dollars for domestic transactions and incentivise exporters through tax cuts to exchange their dollars for rupiah once they finalise transactions.”

The government should also mitigate bureaucracies associated with starting new businesses in the archipelago. This would serve as an incentive for investors who are looking to put their money into the country, long-term.

Kusuma, on behalf of the Central Bank, claims to be monitoring and evaluating the effectiveness of the nation’s existing short-term measures. “In the long run, the government will do structural reformation, especially for anything related to building added value for our exported goods so we will not only rely on natural resources,” he explains. “We also will expand our market [activities] abroad, thus our supply of foreign exchanges will be bigger.”

Kusuma adds, “We are fully aware of how important stability is for foreign and local investors to predict their costs and benefits. Therefore, the Central Bank along with the government will always pay attention to Indonesia’s macroeconomic stability to create a conducive climate for investment.”