Southeast Asian businesses are struggling to adapt to transparency, whereas it is a no-brainer for the Western world to ensure openness and honesty within the market, during this age of excessive information.

Old habits in Southeast Asia are unbreakable since the barriers have hindered the market’s growth in the past: instability, corruption, and a lack of local knowledge.

Emerhub is a leading market-entry service provider for start-ups in Indonesia, Vietnam and the Philippines. Lauri Lahi, the Chairman of Emerhub, had noted that Southeast Asian countries drive from a cultural community, thus relies more on friendly or family relationships and neglect corporate transparency.

“Southeast Asian countries are becoming major economic centres with little to no transparency nowadays. Some concerns usually surface over a period of time: who owns this company? Is it even a legal entity? Do they have the right licenses? Are they paying their taxes?” said Lahi.

Managing the Start-up Boom in Southeast Asia

An unparallel growth happened in the digital and tech sectors. At least 50 percent of Southeast Asia’s population is under 30 years old, and the internet is accessible to 90 percent. Therefore, the start-up boom is blossoming. A new set of entrepreneurs are steering the reins of this youthful, tech-savvy, and heavily commercialised market.

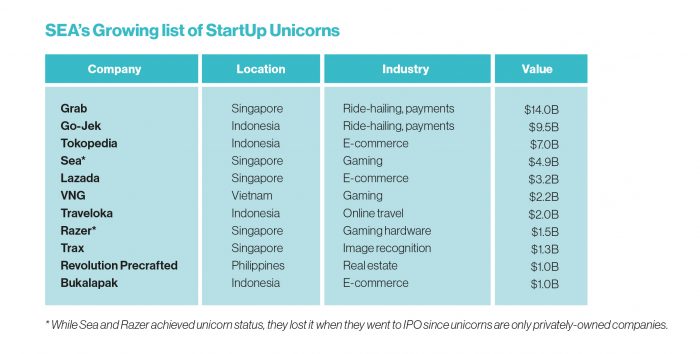

Singapore, Jakarta, Penang, and Ho Chi Minh are some of the cities vying to be the next Silicon Valley. The tech and consumer-driven start-ups have created some “unicorns”, resulting to privately-held companies valued over US$1 billion.

No “unicorns” existed in the early 2010s. There are at least 11 now, with the likes of Gojek, Tokopedia, Grab, and Lazada as household names. Therefore, e-commerce and ride-hailing applications have pushed the region’s online economy to over US$100 billion.

The Southeast Asian market is rather inexperienced though. “It’s easy to get distracted by the smiles and promises of huge potential markets,” said Lahi. “Our advice is to use all the intelligence you can get, even if it means higher costs and slower progress in the beginning. In fact, the biggest mistake companies make is thinking that the opportunity is now or never – it rarely is and it’s better to take your time and be thorough.

Business practices need to be more standardised and less localised

Transparency in Southeast Asia remains inconsistent due to the region being fragmented and localised. You can’t pin point one plan in Jakarta to work in Vietnam. There’s no standard on business practices and regulations, leading to difficulty on finding information on financials, shareholders, and backgrounds.

Clients often request for help to deal with local partner(s) – at times not knowing who the directors or shareholders are, or if the company in question is legitimate. Most Western countries, on the other hand, have government databases to easily find basic information such as financial data, backgrounds, and shareholder information for any registered entity.

All in all, Emerhub pulls many public data (as possible) for Southeast Asian business for their online registry: registry.emerhub.com where registered companies in Indonesia, the Philippines, and Vietnam are found and updated every month.

Access to Financial Statements and Records by Smarter Investment

Investors need information before proceeding to further steps; meanwhile, Southeast Asia doesn’t strive on transparency. Financers need a clear picture of financial statements for performance and operations, debts, and total value. The influx of international investors and talent lead the push for market watchdogs to monitor growth in a maturing market.

“Hopefully, the large start-ups will groom a new generation of future business leaders who build companies with international standards, both in terms of governance and business ambitions. This generation has experience working for an international company with high pressure and they can recreate the culture and standards elsewhere later on,” said Lahi.

Diligence and Honesty Will Curb Corruption

The number one obstacle for investors to do business in Southeast Asia, according to the United Nations Development Program (UNDP), is corruption along with poor governance. The Fair BIZ by UNDP aims to grow and nurture a culture of transparency in Southeast Asia and integrity, by reforming new regulations for starting businesses, protecting investors, enforcing contracts, paying taxes, and so on.

Who owns the companies in Southeast Asia?

Not stomping out the start-up flames will require adapting to a new era of clarity, openness, communication, and accountability for Southeast Asia. As for transparency, the long-term rewards are collaboration, cooperation, and collective decision making.

“Having a more transparent market is beneficial for everyone. It gets easier to do business. The market players need to behave in a certain way, not just solely seeking the government to make the regulations easier,” said Lahi.

All in all, if they are more open and transparent, more investments will come and the cycle of growth can continue.

Get in touch with us via email info@indonesiaexpat.biz to discuss your opportunities in Indonesia further.