Every crisis brings opportunities to start something new. Foreign investors having business plans in mind should turn them into reality, especially now as the business incorporation in Indonesia can be done online, which means remote registration is possible and the process can be as quick as one to 1.5 months.

Just like every other country, Indonesia is striving for economic recovery following the COVID-19 crisis. The efforts are potentially bringing a positive outcome. According to the Indonesia Economic Prospects by the World Bank (2020), real GDP is projected to increase to 4.8 percent in 2021 on recovering private consumption growth. The number is also predicted to increase to 6 percent in 2022 due to strong investment growth and the low base of the previous years.

FOREIGN OWNERSHIP IN INDONESIA

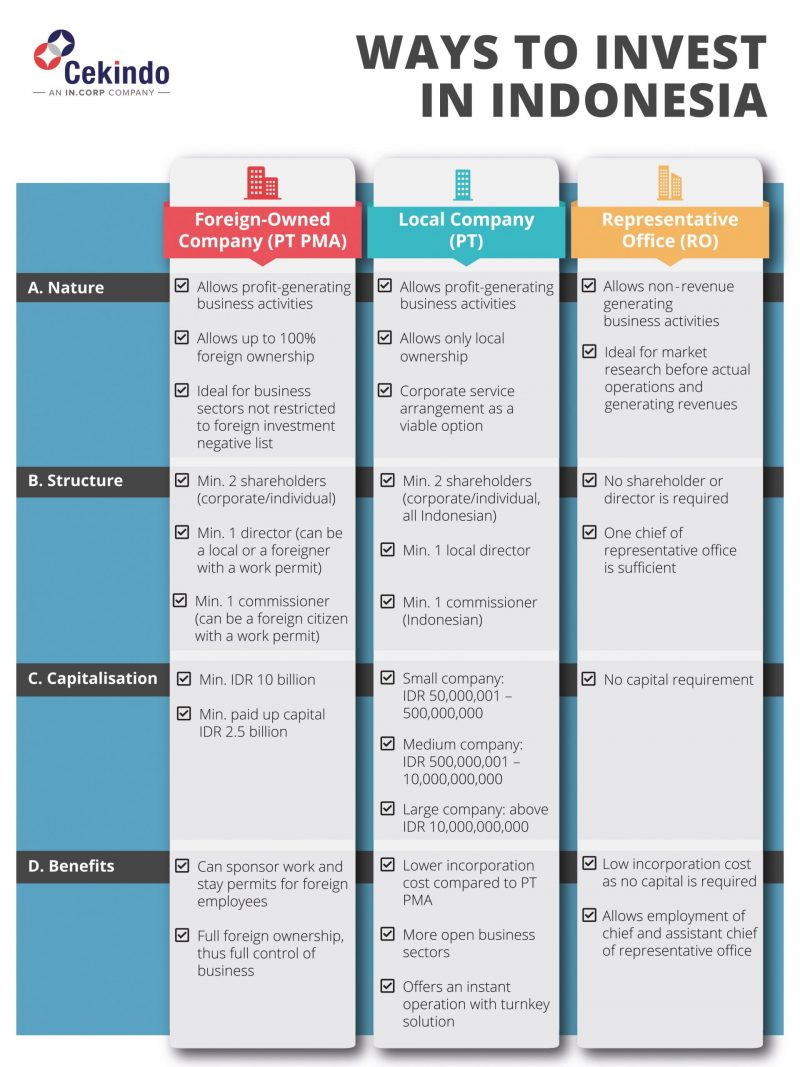

Before incorporating a company in Indonesia, foreigners are recommended to read through the Negative Investment List that regulates allowance and restrictions on foreign ownership.

To make it easier, we have summarised highly profitable sectors for foreigners to tap into, along with their foreign ownership allowance:

- Business sectors that allow 100 percent foreign ownership include e-commerce businesses (minimal investment: Rp100 billion), bars, cafes, restaurants, film studios, sports facilities, hospital services, hospital management and consultancy, raw materials manufacturing for pharmaceuticals, distribution affiliated with production, direct selling through marketing networks, biomass pellets for renewable energy.

- Business sectors that allow a maximum 67 percent foreign ownership include medical equipment testing institutions, internet service providers, call centres, airport activity services, distribution and warehousing, department stores (retail space extent of 400 – 2,000sqm).

- Business sectors that allow a maximum 49 percent foreign ownership include e-commerce businesses (investment below Rp100 billion), land transportation, passenger land transportation, medical equipment supplier, airport services.

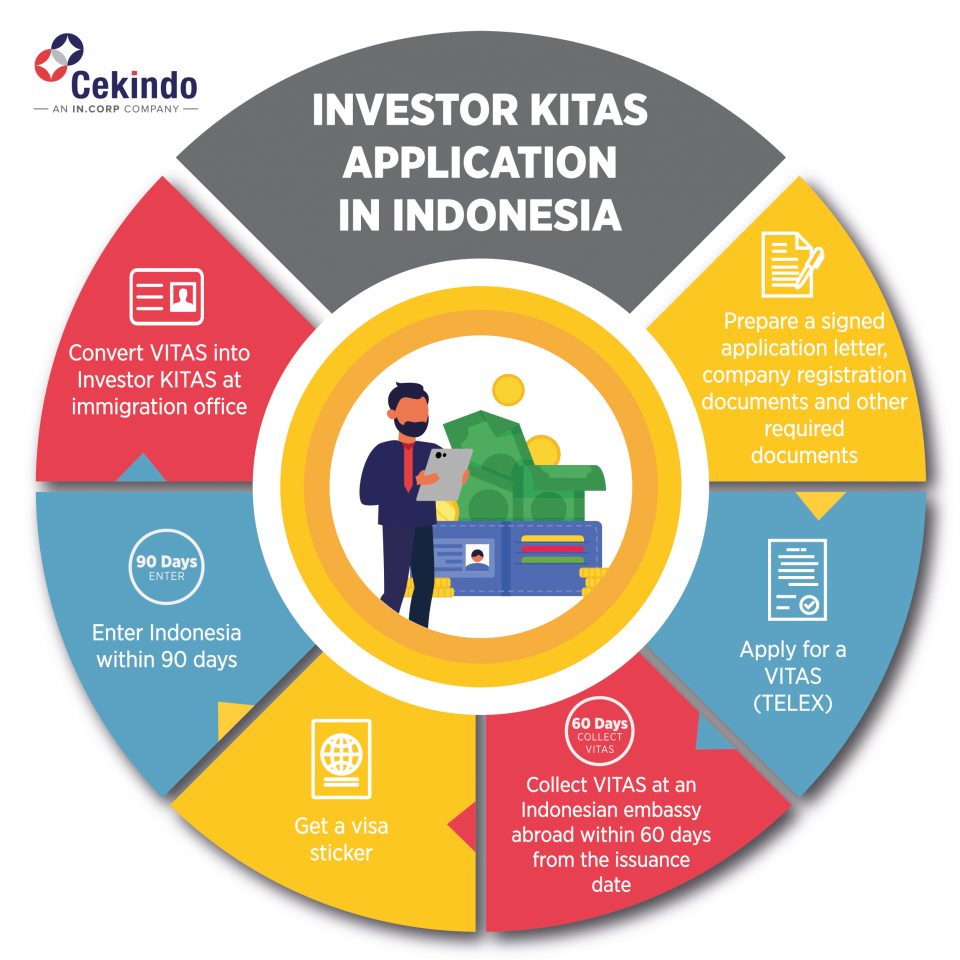

INVESTOR KITAS IN INDONESIA

A significant contributor to the more investment-friendly environment in Indonesia is the existence of what is called the Investor KITAS. The most attractive benefits of having an Indonesian investor KITAS are its easy application and the work permit fee waiver.

After pouring the initial investment, foreign investors do not need to wait for months to start working. Moreover, when all the investment requirements are satisfied, the work permit’s hefty fee amounting to US$1,200 per year no longer needs to be paid.

Foreign investors can choose between a one-year or a two-year Investor KITAS and can enter and leave Indonesia unlimited times provided that the KITAS is still valid. Additionally, an Investor KITAS is faster to obtain than a regular Work KITAS.

To be eligible, these requirements must be satisfied: a minimum of Rp10 billion in authorised capital, Rp2.5 billion in paid-up capital and Rp1 billion in personal shares.

AFTER INCORPORATION IN INDONESIA, WHAT’S NEXT?

Opening a corporate bank account is a mandatory post-incorporation process. Foreigners can establish an account at a bank licensed as a Foreign-Exchange Bank so that it can handle foreign currencies.

Furthermore, businesses that are importing goods into Indonesia or exporting goods from Indonesia are required to go through the customs registration process. Exemptions apply to companies whose customs service data are present in the Directorate General of Taxes’ administration system and/or companies performing data exchange with institutions that are in cooperation with the Directorate General of Customs and Excise.

Finally, all companies doing business in Indonesia, both locally and foreign-owned, are required to fulfil the corporate income tax obligations. In Indonesia, a general flat rate of 25 percent applies. Small enterprises with an annual turnover of less than Rp50 billion are eligible to enjoy a 50 percent discount off the standard corporate income tax rate.

CONSULT A PROFESSIONAL

Complying with local regulations of company establishment, KITAS application and business licences, among others, may be challenging to foreign investors. For a step-by-step guide, consult a reliable business consultant for free: go.cekindo.com/invest-indonesia.