Will we see Bitcoin’s triumph over gold?

Your financial ambitions likely extend far into the future, encompassing dreams like home-ownership, travelling around the world, and a comfortable retirement in familiar surroundings.

However, relying solely on conventional savings might not suffice to realise these aspirations, especially given the erosive effects of inflation. That is where alternative asset classes come into play, offering a potential hedge against inflation’s bite over the next decade or beyond. One such asset, often hailed as “digital gold,” is Bitcoin.

But how does this digital alternative stack up against traditional gold regarding long-term investment viability?

Bitcoin vs. Traditional Gold

In the current world of investment, at least two heavyweights stand out: gold, the age-old haven asset, and Bitcoin, the digital disruptor reshaping the financial landscape. While both offer avenues for wealth preservation, a closer examination reveals a stark contrast in their performance over the years.

Before digging into a detailed comparison of these investment assets, let’s revisit their strengths and weaknesses.

Gold Investment

Gold offers several advantages. Firstly, it is highly liquid and easily converted into cash when needed. Additionally, gold prices tend to remain relatively stable, serving as a hedge against economic uncertainty during times of pandemics, or recessions.

Moreover, entering a gold investment can be a manageable initial capital investment. For instance, at the time of writing, the price of gold stood at US$2,021 per ounce or around US$64 per gram.

However, there are drawbacks to investing in gold. After you purchase gold and walk away from the store, the selling price immediately decreases, similar to the experience at a currency exchange. Also, if you lose your gold certificate and the purchase receipt, the selling price will be significantly decreased.

Storing physical gold poses another challenge, requiring secure and often costly storage solutions. Additionally, gold’s value remains static unless additional quantities are acquired. It means one kilogram of gold today will retain the same value in 20 years.

Bitcoin Investment

Bitcoin remains the dominant force in the crypto market with the highest market capitalisation. Accessing Bitcoin is easy, especially with user-friendly platforms like Luno allowing seamless buying, selling, and exploring the crypto world.

Often referred to as “digital gold,” Bitcoin’s correlation with gold surged in March 2023. Research by analytical firm Kaiko reported that Bitcoin’s correlation to gold stands at 57%, meaning that Bitcoin is gaining recognition as a hedge against inflation and financial uncertainty, particularly noted during the COVID-19 pandemic.

Economists like Deutsche Bank’s Marion Labore affirm Bitcoin’s role as digital gold, citing its limited supply — capped at 21 million Bitcoins — and historical tendencies for people to seek assets independent of government control during economic instability.

Indeed, behind its advantages, Bitcoin, like any crypto has its drawbacks. As a highly volatile asset, its value can fluctuate significantly over short periods.

Every investment asset comes with its unique set of advantages and disadvantages. The key lies in understanding your financial objectives and carefully analysing the risk and return associated with each investment option.

By doing so, you can select the most suitable “vehicle” to help you reach your financial goals effectively.

Price Movement of Bitcoin and Gold Over the Years

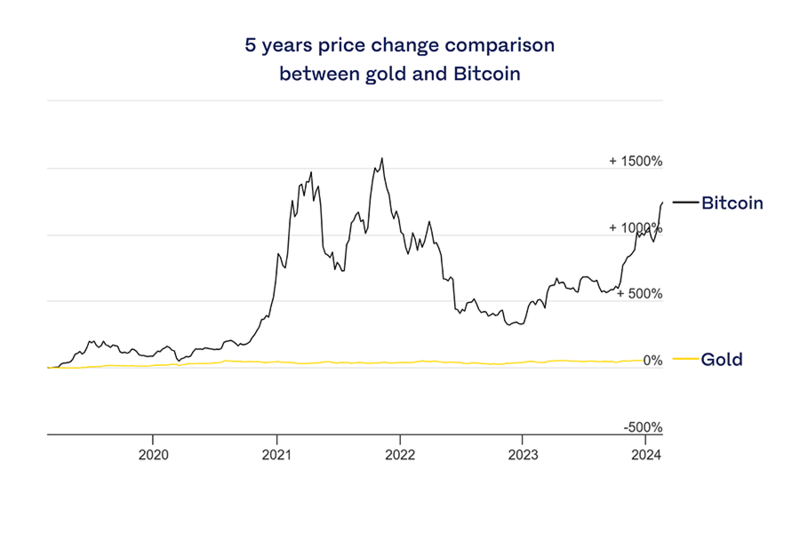

Now, let’s dig into a real-world comparison of investment returns between Bitcoin and gold over five years.

Imagine you had invested US$100 in both assets five years ago. At that time, gold was trading at around US$42 per gram, yielding approximately 2.36 grams for your investment. At the same time, Bitcoin commanded a price of US$3,850 per coin, resulting in roughly 0.026 Bitcoin.

Fast forward to the end of February 2024, and the landscape looks vastly different. Gold’s price has increased to US$64 per gram, translating to a current value of US$151.04 for your initial investment. On the other hand, Bitcoin’s meteoric rise has propelled its price to US$55,000 per coin, catapulting your investment’s value to an astounding US$1,430.

The numbers speak for themselves: while your gold investment has grown by a respectable 51%, Bitcoin has surged by an astonishing 1330%. In terms of final value after five years, your Bitcoin investments have outperformed your gold investments by 9.4 times.

This compelling comparison underscores the transformative potential of Bitcoin as a superior investment asset, offering significant long-term returns and outpacing traditional assets like gold. As the financial landscape continues to evolve, embracing the digital revolution may pave the way for unprecedented wealth accumulation and financial independence.

As a superior investment asset, Bitcoin is also trusted by many huge corporations in the world to diversify their investments. Some examples of companies investing in Bitcoin are MicroStrategy – an analytics and business intelligence company – which currently holds 174,530 Bitcoins or valued at almost US$10 billion, and Tesla – an automotive and clean energy company – which currently owns 10,500 Bitcoins, equivalent to US$ 590 million.

Bitcoin: A New Avenue for Wealth Generation

Bitcoin is often likened to traditional gold due to its similar attributes: rarity, limited supply, and divisibility.

Analysing the price charts of Bitcoin and gold over the past five years reveals that while gold remains a steadfast investment choice, the meteoric ascent of Bitcoin heralds a new era of wealth accumulation and fresh opportunities.

Rather than completely forsaking gold, diversifying your portfolio is paramount for risk mitigation and profit maximisation. The key lies in aligning your investment choices with your financial objectives.

Buy Your First Bitcoin at Luno!

Luno is a trusted crypto app from the UK available in more than 40 countries and has served its loyal customers for over ten years. With Luno, you can buy Bitcoin, store assets, and access the crypto world 24/7 from anywhere.

Visit www.luno.com to get the latest information from the crypto world and start your first Bitcoin investment by downloading the Luno app, available on Google Play and the App Store. Use INDOEXPAT promo code while registering on Luno to get free Bitcoin worth Rp100,000.

Luno is registered and supervised by the Commodity Futures Trading Regulatory Agency (Bappebti). Trading and investing in crypto assets are a high-risk activity. Read more on our Terms of Use here: www.luno.com.

For more information:

- WhatsApp: +62 817-7990-1001

- Email: [email protected]

- Website: www.luno.com