Living in Indonesia can be great fun — without compromising your financial comfort.

Becoming an expatriate in Indonesia is an exhilarating adventure for those who enjoy learning new things and stepping out of their comfort zones. Nonetheless, living and working abroad brings challenges beyond disparities, from weather-related aggravations to possible cultural shocks. Having said that, perhaps one of the most pivotal aspects demanding attention is a series of financial challenges that might be encountered by an expat.

Understanding Common Financial Challenges for an Expat

Financial problems are universal, though they usually take on a unique flavour when living aboard. Awareness of these problems and how to adopt a proactive approach are crucial to ensuring financial stability, all while also embracing the expat lifestyle.

Thus, the first step in overcoming those problems is to recognise their existence and understand how they can impact your financial well-being. By understanding common financial problems, you can anticipate or, at least, minimise the risk before it happens. Here are some ways to overcome any financial challenges.

Managing Income and Expenses

Challenge: It might be difficult to manage your finances when you are unaware of your income and expenses.

Solution: Create and maintain a detailed budget that includes all aspects of your financial life. Knowing where your money comes from and where it goes is crucial for effective financial management. Also, you need to make sure where you will store your wealth. For example, you could consider creating a simple list or note of your monthly income and expenses. By doing that, you will know which part of your expenses can be reduced and whether there is any way to increase your income.

Currency Differences

Challenge: Dealing with currency differences can result in imprudent spending, especially when the local currency holds a lower value than your home country. It can create an illusion of affordability, making everything appear inexpensive so that awareness of managing finance is lost.

Solution: Besides grasping the value of local currency, it’s crucial to acknowledge that you are a resident here. Therefore, aligning your expenses with those of the average local person becomes essential to cater to daily needs effectively.

Tax Implications

Challenge: Foreign workers employed in Indonesia have rights and obligations regulated by the prevailing laws and regulations in the country, including those related to taxation. Therefore, it is important that you precisely comprehend your tax rights and obligations to prevent legal and financial complications. But how?

Solution: Do your research and seek professional advice to comprehend the tax implications of your expat status. It will help you navigate the tax landscape and ensure compliance. You have to be aware of what and how much taxes you will pay so that you can include it in your budget plan.

Store your Wealth

Challenge: While banks are a viable option for storing and managing wealth or assets, it’s worth noting that the reach of bank services has limitations, primarily regarding transactions. This hurdle becomes especially pronounced for individuals who frequently relocate from one country to another.

Solution: Explore flexible options such as crypto to store your wealth. Crypto provides seamless transactions worldwide, offering easy and safe alternatives to traditional methods. With crypto, you can access your wealth and also, transfer it anywhere in the world within seconds.

Investment Challenges

Challenge: Investing overseas can be challenging due to differences in currency, market regulations, and market time schedules. It means you have limited time and access to manage your investments.

Solution: Embrace the global accessibility of cryptocurrency for investment. Blockchain and crypto operate 24/7, allowing you to access and manage your investment anytime and anywhere in the world without worrying about moving it.

Bottom line: Navigating financial challenges as an expat can be manageable. Consider consulting with financial experts who specialise in expatriate finances. They can provide personalised guidance tailored to your unique situation, ensuring a smoother financial journey abroad.

Also, you may consider utilising crypto to conveniently store wealth and the swift, cost-effective transfer of large amounts of money abroad in real-time.

By being proactive and staying informed, expatriates in Indonesia can turn financial challenges into growth and financial success opportunities. Remember, a well-managed economic life contributes significantly to a fulfilling expat experience.

Where Can I Safely Store and Invest in Crypto?

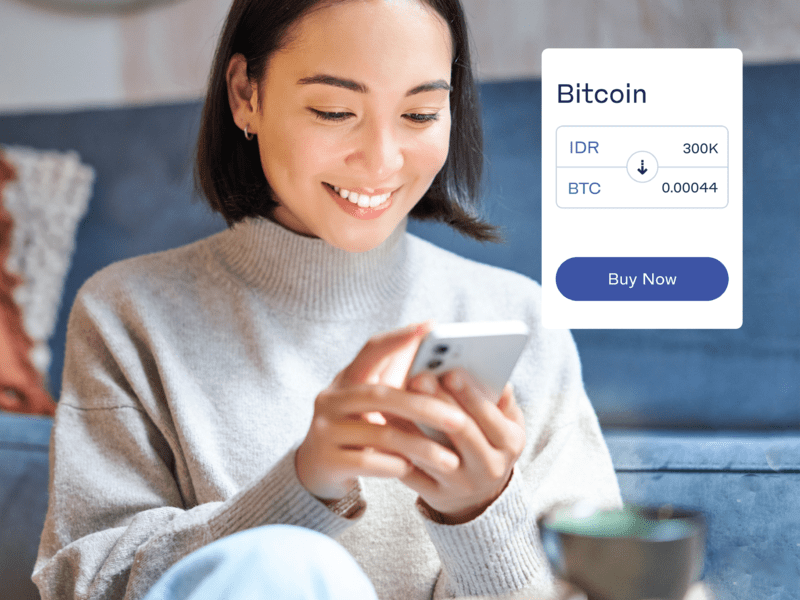

Meet Luno – a crypto investment application registered and supervised by BAPPEBTI – Indonesia Commodity Futures Trading Regulatory Agency. Luno is a global crypto app from the UK and is available in more than 40 countries, including Australia, Malaysia, the UK, South Africa, the European Union, and Indonesia.

With Luno, you can safely and easily buy, store, and explore the crypto world anytime and anywhere. If you need help while using Luno, don’t worry — our English-fluent customer service team from Indonesia, Malaysia and South Africa are ready to help you.

Visit www.luno.com to learn and explore more about crypto. The Luno app is available on Google Play Store or App Store if you want to start investing in crypto soon. You can use INDOEXPAT code while registering on the Luno app to get free Bitcoin worth Rp100,000.

Luno is registered and supervised by the Commodity Futures Trading Regulatory Agency (Bappebti). Trading and investing in crypto assets are a high-risk activity. Read more on our Terms of Use here: www.luno.com.

Luno Indonesia

- WhatsApp: +62 817-7990-1001

- Email: [email protected]

- Website: www.luno.com