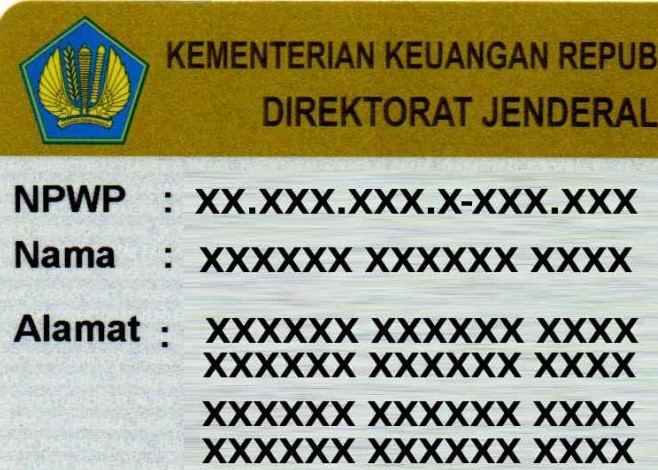

The Directorate General of Taxes will use the national identification number (NIK) and 16-digit taxpayer identification number (NPWP) when administering taxpayers from October 2023.

For individual foreign taxpayers, entities, and government agencies who are existing taxpayers, the 15-digit NPWP will be changed to 16 digits by adding the number 0 in front of the current tax identification number (TIN). Foreign individual taxpayers, entities, and government agencies who are new taxpayers will immediately receive a 16-digit tax number when registering.

For individual Indonesian taxpayers, the NIK will be used as the NPWP in accordance with the mandate of law 7/2021 concerning the Harmonisation of Tax Regulations (HPP). The NIK will be activated immediately by the Directorate General of Taxes who will inform the taxpayer of the activation.

“In the future, only 16 digits will be used, so there are no more 15 digits. We will implement it gradually,” said Director of Information and Communication Technology of Directorate General of Taxes (DJP) Hantriono Joko Susilo on Friday 14th January.

If the taxpayer voluntarily registers, there will no longer be the term registering a current tax identification number. NPWP registration is replaced with NIK activation.