Like any other country in the world, Indonesia has enticing opportunities that expats cannot dismiss.

Whether it is to immerse yourself in diverse cultures as a way to recharge, set up new business ventures, or completely leave what was once familiar behind for something new – Indonesia is not to be taken for granted.

One of your many “big” decisions of the year is taking that enticing job offer in Indonesia. Thrilled, you’ve made all the necessary preparations for relocation. You’ve touched down to this tropical wonder where it’s scorching during the day and raining cats and dogs at night. You’ve come to terms with a new way of life and you dearly enjoy it. There’s big city life, nature, culture, and many other aspects that convince you: “I am never looking back“.

The plan on a fine Sunday morning is to go hiking and replenish in the misty waters of a nearby waterfall with friends. Everyone is having a blast, especially you. A conversation about health dominated the ride home. You voiced your concern over your existing health insurance not fully covering everything. “Sounds like Roojai Indonesia could do the trick. Marc had a terrible accident while cycling in Bali. He uses Roojai’s Personal Accident insurance. Even though the main benefits include cash payment in case of death or permanent disability when caused by an accident, it also provides cashless treatment at partner hospitals after an accident,” explained Nina, a fellow expat who had arrived in Jakarta a couple of months earlier.

Intrigued, you scroll onto www.roojai.co.id to learn more. Roojai Indonesia is a new start-up providing affordable, customisable, reliable, and transparent online insurance in cooperation with Sompo Insurance Indonesia, led by insurance experts with decades of experience. It has been several months since Roojai emerged here, with Roojai Thailand – founded in 2016 – serving over 130,000 customers per year with over 300 employees.

“Get your insurance quote in just a few clicks,” states the homepage. Options to click on include critical illness, cancer, heart disease, a mosquito-borne illness, hospital cash plan, and personal accident. There are three main plans to consider:

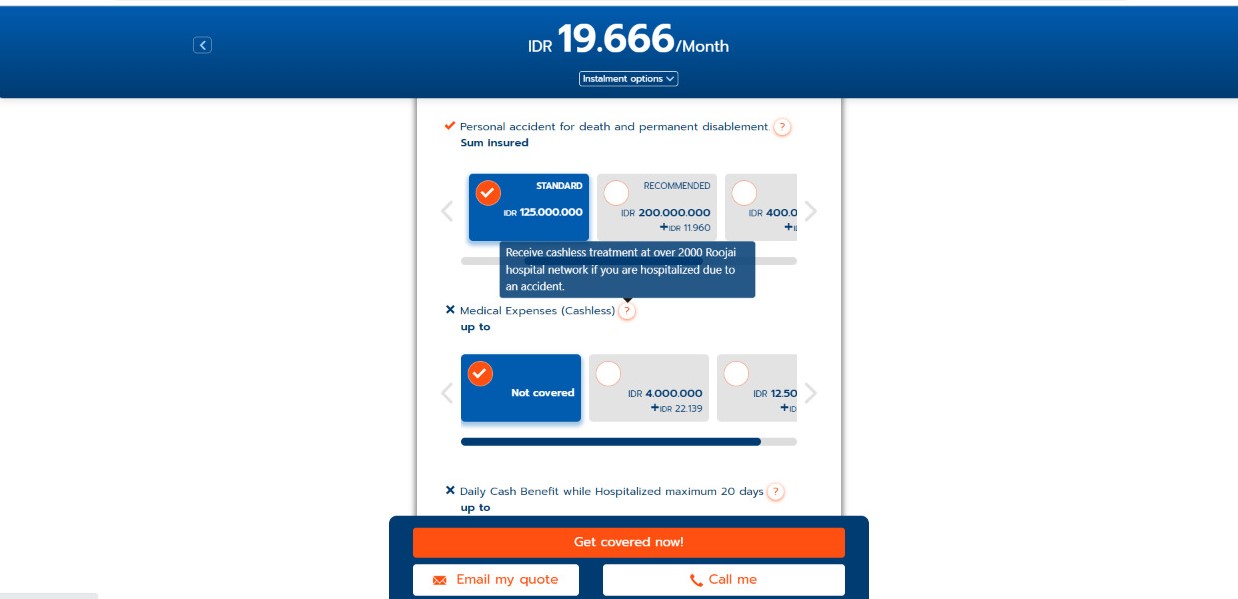

Personal Accident Insurance

Up to Rp800 million cash payout with additional optional coverage such as for accidents with two-wheelers and extreme sports.

2. Hospital Cash Insurance

Up to Rp2 million cash payout per day of being hospitalised, along with additional cash for further treatment, etc.

3. Critical Illness Insurance

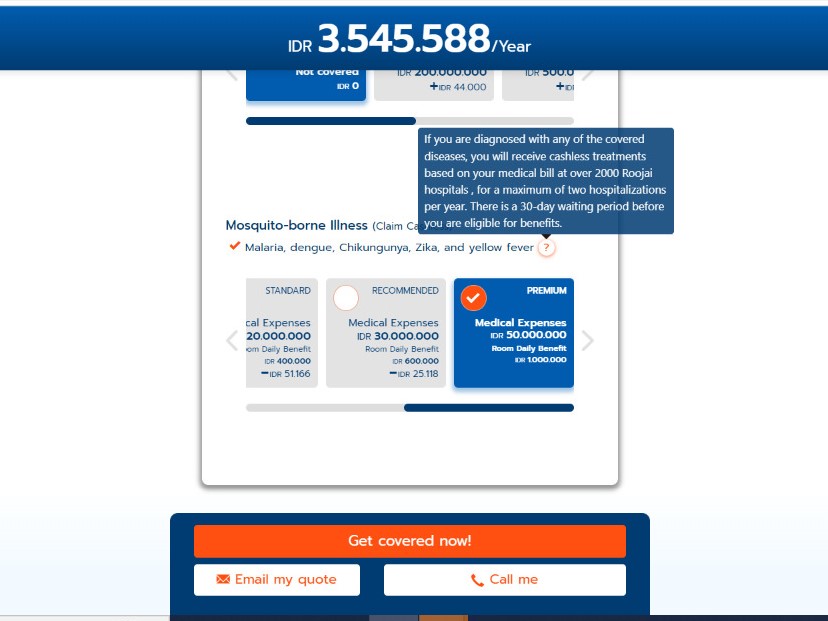

Up to Rp1 billion cash payout, or cashless treatment at partner hospitals for mosquito-borne illnesses. Cancer, heart diseases, and mosquito-borne options are within this plan. Thus, separately or combined purchases adheres to personal preferences.

“What if, knock on wood, a life-threatening disease creeps up out of nowhere in the future, leaving me more vulnerable than I can ever imagine?” your thoughts spiralled while choosing a plan. Critical illness insurance it is.

Upon clicking on the IV/blood pack image, a few questions about your gender, marital status, occupation, date of birth, height, weight, and medical status are asked. Once done, you click on “Get your quote now!” which directs you to your personalised pricing, paid monthly or annually. Proceed to choose the optional coverage options until you reach the final click: “Get your coverage now!” for immediate input of policy and payment details; “Call me” to speak directly with Roojai’s highly-trained, English-speaking call centre agents; or “Email my quote” for another form of communication if phone calls are not ideal.

You find the user experience of the website is not at all complicated – it is easy to navigate, straightforward, and most of all, transparent. Transparency is vital for a better understanding of what you are acquiring, the reason behind the quote, and thorough explanations of the products are visibly stated. Within minutes, your policy is released without the hassle of conducting a medical check-up. Simply answer a few questions! Contact details prior to obtaining quotes aren’t asked either, except when you specifically opt to be contacted.

Welcoming a new month with high hopes, your body starts to feel overwhelmed. You decide to pay the doctor a visit to rule out this unwavering sensation; sudden high fever, muscle aches, severe headache, nausea and vomiting, and fatigue. Mostly alarming are the tiny red spots covering every inch and corner of your skin.

Blood tests are drawn, after which you discover it is dengue fever; a mosquito-borne viral disease occurring in tropical and subtropical areas, e.g. Indonesia. Anyone living in Indonesia who doesn’t adhere to the recommended steps of creating a safe space away from the Aedes Aegypti and Aedes Albopictus mosquitoes is at risk of getting dengue, unfortunately. The doctor advises you to seek treatment at the hospital for a few days, which turns into a week.

Weak and confused, you luckily remember Roojai offers cashless treatment at their network hospitals, and you were able to check before agreeing to be hospitalised. Thus, your finances aren’t burdened as your hospital treatment is cashless thanks to the Mosquito-borne Disease Insurance that you purchased a few months ago. With ease of mind, health practitioners nurse you back to optimal health.

For many of their products, Roojai acts as a top-up of any current health insurance and provides cash payments based on the plan chosen, not based on actual medical cost. For example, the worst-case scenario leads you to be diagnosed with cancer. You are able to access up to Rp1 billion cash payout. Aside from that, self-employed individuals – digital nomads for instance – can be compensated with hospital cash under the Hospital Cash Plan product. Think of it as substitute income while being hospitalised. Losing a couple of days behind the laptop due to health concerns will, unfortunately, halt your income yet Roojai ensures this won’t occur. Remember, ease of mind for someone unwell will turn into a speedy recovery.

At least 2,000 hospitals and clinics in Indonesia are listed under Roojai’s network. Though accessing Roojai is only available online, it isn’t an aggregator or marketplace selling different insurance brands. It’s a fully integrated insurtech. Privacy and efficiency, indeed. Car insurance and international health insurance are planned to be available in 2023.

If you’re a 25 to 55-year-old, a middle-income expat from any origin of country excluding from blacklisted countries based on international regulations who’s self-employed, a digital nomad, a traveller mostly based in Bali and Jakarta for at least six months or basically someone lacking sufficient health insurance coverage and/or wants to protect their finances against illness and accidents, give Roojai a shot. Payment claims are only reimbursable in Indonesian Rupiah to local bank accounts – make sure to have one created. Each insurance plan lasts for a year.